I’ve always been pretty terrible at budgeting even though I love to make spreadsheets and keep track of numbers. I just never found the time to make and keep track of a budget. So I finally decided to do it for the month of September and I wanted to share with you how to set up a monthly budget. I use a combination of a paper planner and an online calculator.

Where To Start When Setting Up A Monthly budget

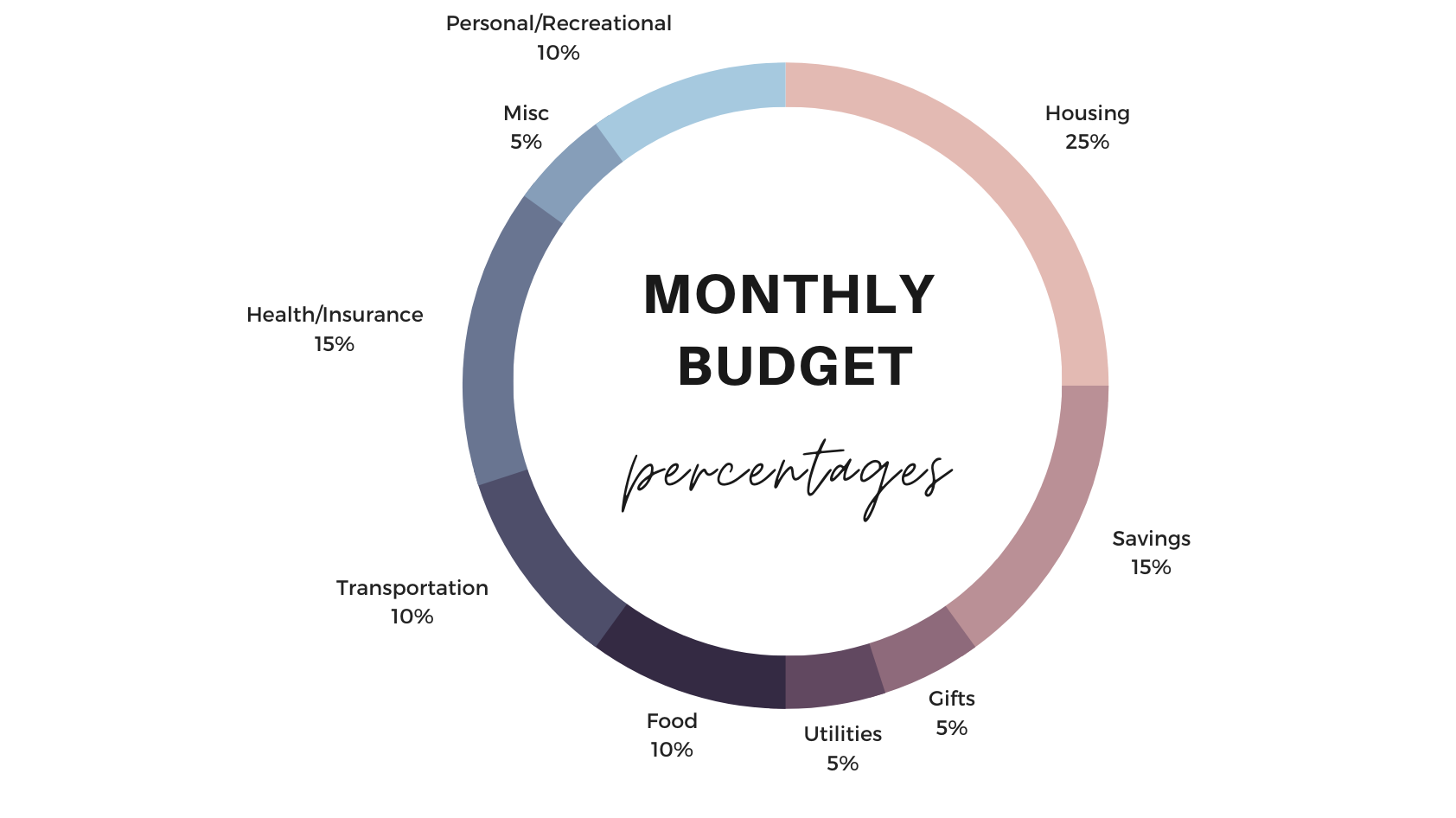

It’s hard to know where to start when making a budget. You may have heard of Dave Ramsey – I haven’t read any of his books but I know he is a financial guru. As I was doing some research for this blog post, I came across some recommended budget percentages. I edited and combined a couple of the categories but kept the percentages similar to his recommendations in the graphic I created below.

Also, this website has a ton of great financial calculators. Their personal budget planner allows you to put your net income in and it will calculate amounts based on Dave Ramsey’s percentages.

I wanted to see how our expenses aligned to the recommended percentages so I went through all of our finances from last month. Here’s how our household stacked up:

| CATEGORY | Goal | Actual |

| Housing | 25% | 27% |

| Savings | 15% | 24% |

| Utilities | 5% | 5% |

| Food | 10% | 15% |

| Personal/Recreational | 10% | 14% |

| Transportation | 10% | 6% |

| Insurance | 10% | 2% |

| Gifts | 5% | 0% |

| Misc. | 5% | 5% |

How To Track Your Monthly Budget

I’ve tried several apps for budgeting and I never seem to stick with them. This is one thing that I plan to put on paper in my plum paper planner and I’m hoping that having it in front of me will help me stick to my budget and see how the month is progressing.

I have a section for tracking our income, the categories that I outlined above, and our weekly spending. I’m going to write down the estimated amounts and then record our actual at the end of the month. Some categories will be pretty much the same every month but I think we could make some improvements in the food category and personal spending. I would like to allocate some funds to a specific charity each month as well.

Have you set up a monthly budget? Do you prefer tracking your finances on paper or electronically?

Leave a Reply